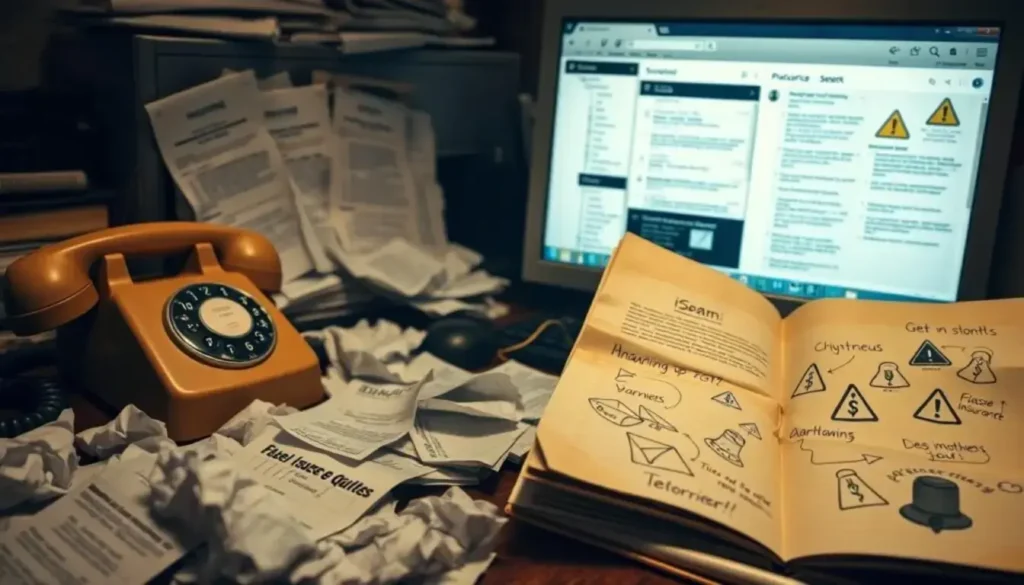

The phone rings unexpectedly. Another unsolicited insurance quote lands in your inbox. You’re not alone in this frustrating experience. Fake insurance quotes and phone calls spam have become a serious threat to your security.

Discover how to protect yourself from fake insurance quotes phone calls spam car and learn proven strategies to avoid scammers targeting your personal information and finances

Insurance companies like State Farm, Nationwide, and AllState use lead generation websites to send quotes. They often do this without your consent. These tactics put your personal information at risk of identity theft and financial scams.

Unsolicited calls targeting consumers have reached epidemic levels. From car insurance scams to fake medical discount plans, scammers are getting smarter. They aim to steal your sensitive data.

Table of Contents

Key Takeaways

- Unsolicited insurance quotes are a growing nationwide problem

- Lead generation websites play a significant role in distributing personal information

- Scammers use sophisticated techniques to appear legitimate

- Your personal data is constantly at risk from fraudulent insurance practices

- Awareness is the first step in protecting yourself from phone calls spam

Understanding the Rise of Insurance Quote Spam Calls

Insurance spam calls are a big problem for people. Robocalls use smart tricks to reach out to those who might be looking for insurance quotes. This has made it easier for scammers to steal personal info from people who are just trying to get quotes.

https://youtube.com/watch?v=gMsEx5tHK1s

Scammers have found ways to get personal info through different means. They use clever tactics to make fake insurance offers seem real. This is how they trick people into giving them their personal details.

Sources of Personal Information Acquisition

- Public records databases

- Online data aggregation platforms

- Social media profile scraping

- Purchased marketing lists

Lead Generation Website Strategies

Lead generation websites are key in sharing customer info. These sites often sell personal data without checking if it’s real. This makes it easy for bad guys to get hold of your info.

| Scam Tactic | Frequency | Risk Level |

|---|---|---|

| Auto Insurance Quote Scams | 44 million captured calls | High |

| Personal Information Theft | 5.3% of potential scam calls | Critical |

Telemarketer Manipulation Techniques

Insurance telemarketers use smart ways to get your info:

- Submitting fake applications that seem real

- Using many sources to find leads

- Getting past weak checks on who they are

- Making fake quote requests look real

“Protecting your personal information is crucial in preventing insurance quote spam calls.” – Consumer Protection Expert

fake insurance quotes phone calls spam car: Anatomy of the Scam

Auto insurance scams are getting smarter, aiming at drivers in many ways. With over 278 million vehicles in the U.S., scammers have a huge number of people to trick.

Criminals use many tricks to fool drivers:

- Staged Accidents: Scammers make dangerous situations on the road

- Bystander Scams: Fake helpers suggest expensive repair services

- Fraudulent insurance sales calls targeting vulnerable drivers

“Scammers are becoming more ingenious in their approach to deceptive insurance sales calls,” warns consumer protection experts.

Here are some common scam methods:

- The “Swoop and Squat” – Intentionally causing rear-end collisions

- Parking lot insurance claim fraud

- Unnecessary auto glass repair scams

Scammers use advanced tricks to make calls seem local. They use vehicle info to pick who to target.

To stay safe, be careful. Always check if insurance quotes are real. Don’t give out personal info to unknown callers.

Insurance Quote Robocall Prevention Strategies

To avoid insurance spam calls, you need to be proactive. Unsolicited insurance quotes can risk your personal info and money. It’s important to protect yourself.

Scammers use insurance calls to steal money. The Coalition Against Insurance Fraud says fraud costs $308.6 billion a year. Knowing how to spot and stop these scams is key.

Identifying Legitimate Insurance Calls

To tell real insurance calls from fake ones, follow these steps:

- Ask for official ID from the caller

- Call your insurance company directly

- Don’t share personal info on unsolicited calls

- Check the Do Not Call Registry

Steps to Take with Unsolicited Quotes

Here’s what to do with unexpected insurance quotes:

- Ask where they got your info

- Look up the insurance company yourself

- Don’t make quick decisions

- Report spam calls to the right places

Legal Protections Against Insurance Spam Calls

The U.S. has laws to protect you from insurance spam:

- The Do Not Call Registry by the Federal Trade Commission

- State insurance rules

- Right to file complaints with state Insurance Departments

- Report spam to the Better Business Bureau

“Knowledge is your best defense against insurance quote scams.” – Consumer Protection Expert

Stay alert and keep your personal info safe from insurance quote scams.

The Hidden Dangers of Unsolicited Insurance Quotes

Unsolicited insurance quotes might seem harmless, but they hide big risks to your personal data. Scammers use clever ways to trick people into giving out their personal info. This is a big financial scam targeting many unsuspecting folks.

The world of identity theft is very scary. Recent numbers show a huge financial loss:

- Americans lost over $8.8 billion to fraud in 2022

- Only 2.4 million scams were formally reported to the FTC

- Nearly half of all scams involved phone calls and texts

Insurance quote spam calls are a big risk for your personal info. Criminals use these calls to get your sensitive info. They then sell it on secret markets.

“The most dangerous scams are those that appear most legitimate” – Cybersecurity Expert

To stay safe, be careful with unsolicited insurance quotes. Don’t give out personal info to unknown sources. Insurance fraud can hurt your finances a lot.

- Verify the source of any insurance communication

- Do not share personal information over unexpected calls

- Research companies independently before engaging

Your personal info is very valuable. Treat it as such.

Costco Car Rental Insurance: What You Need to Know

Conclusion

Protecting yourself from fake insurance quotes is key. You need to stay informed and know how to spot scams. The insurance world must act ethically to fight off scams that target people every day.

With over a million fake calls made daily, being alert is crucial. Insurance reform is vital to stop scammers from taking advantage of people. Fair prices and strong checks can make insurance safer and more honest.

Working with trusted insurance companies and websites is your best defense. Always check if an offer is real, be wary of unexpected calls, and don’t share personal info with unknown callers. The Federal Trade Commission suggests reporting suspicious calls to fight scams.

Stopping insurance scams needs everyone’s help. Stay alert, doubt offers that seem too good, and keep your personal and financial info safe. Together, we can make insurance safer for everyone.

FAQ

What are fake insurance quotes phone calls?

Fake insurance quotes phone calls are unwanted calls from scammers. They try to get your personal info or sell fake insurance. These calls often start with fake online applications with some correct details.

How do scammers obtain my personal information for these calls?

Scammers get your info from public records, online data, and lead sites like insuranceQuotes. They use some correct info to seem real.

Are these unsolicited insurance quotes dangerous?

Yes, they are very dangerous. They can lead to identity theft, scams, and data exposure. Scammers use these calls to start bigger frauds, putting you at risk.

How can I protect myself from fake insurance quote calls?

To stay safe, check who’s calling and call your insurance company directly. Sign up for the Do Not Call Registry. Don’t give out personal info to unknown callers. Look up insurance options yourself and watch out for sudden accident tips.

What are common tactics used by insurance quote scammers?

Scammers use fake apps with some right info, gather data from many sources, and exploit identity gaps. They stage accidents and recommend expensive services or repair shops.

Can I report these fraudulent insurance quote calls?

Yes, you can report them to your state’s Insurance Department, the Better Business Bureau, or the Federal Trade Commission. Give as much detail as you can to help stop these scams.

What legal protections exist against insurance spam calls?

There are laws like the Do Not Call Registry, state insurance rules, and consumer protection laws. These help limit unwanted calls and offer help if you get too many.

How widespread is the fake insurance quotes problem?

It’s a big problem, with thousands getting unwanted quotes every day. Insurance companies and lead sites keep sending out leads without checking them well. It’s a big worry for people looking for real insurance.